"Flavien Vidal" (flyingfrenchy)

"Flavien Vidal" (flyingfrenchy)

06/23/2016 at 23:41 ē Filed to: None

0

0

75

75

"Flavien Vidal" (flyingfrenchy)

"Flavien Vidal" (flyingfrenchy)

06/23/2016 at 23:41 ē Filed to: None |  0 0

|  75 75 |

Thatís gonna be a very interesting next 3 or 4 years :)

You guys can say good bye to boose-cruises though lol

JQJ213- Now With An Extra Cylinder!

> Flavien Vidal

JQJ213- Now With An Extra Cylinder!

> Flavien Vidal

06/23/2016 at 23:45 |

|

Iím so confused about this whole thing.

Can you explain simply?

For Sweden

> Flavien Vidal

For Sweden

> Flavien Vidal

06/23/2016 at 23:46 |

|

Iíve got a fiver; can I buy Lotus?

djmt1

> JQJ213- Now With An Extra Cylinder!

djmt1

> JQJ213- Now With An Extra Cylinder!

06/23/2016 at 23:48 |

|

The people of the UK had a vote as to whether or not to remain a member of the EU and weíve just said no.

BorkBorkBjork

> Flavien Vidal

BorkBorkBjork

> Flavien Vidal

06/23/2016 at 23:48 |

|

The real question is, why didnít they wait another 11 days to have this vote?

whoarder is tellurium

> Flavien Vidal

whoarder is tellurium

> Flavien Vidal

06/23/2016 at 23:49 |

|

I want a Cozzy

Shmevans

> JQJ213- Now With An Extra Cylinder!

Shmevans

> JQJ213- Now With An Extra Cylinder!

06/23/2016 at 23:50 |

|

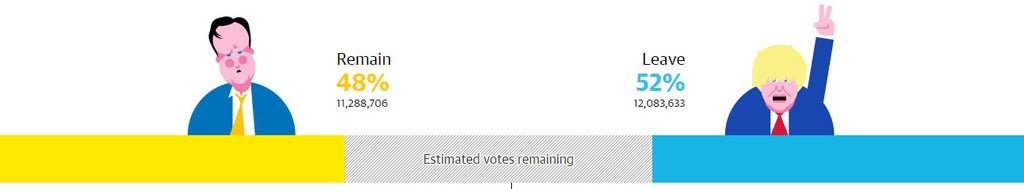

The UK is voting on whether or not to remain a part of the European Union. The sides are Leave and Remain (like parties in an election). So far itís 48.3% Remain and 51.7% Leave after nearly 80% of the votes have been tallied.

TwinCharged - Is Now UK Opponaut

> For Sweden

TwinCharged - Is Now UK Opponaut

> For Sweden

06/23/2016 at 23:55 |

|

Gotta wrestle it off the Malaysians m8

The Dummy Gummy

> JQJ213- Now With An Extra Cylinder!

The Dummy Gummy

> JQJ213- Now With An Extra Cylinder!

06/23/2016 at 23:57 |

|

UK people bought into the fear mongering and now theyíre about to feel real pain after leaving the E.U.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/23/2016 at 23:58 |

|

Will this mean even more dirty offshore money being laundered in London real estate, or will it flee elsewhere? I suppose it might take a few years to really know.

I canít blame the Limeys for wanting to flee the Brussels bureaucrats, and some might be upset about being blackmailed by economics.

TwinCharged - Is Now UK Opponaut

> whoarder is tellurium

TwinCharged - Is Now UK Opponaut

> whoarder is tellurium

06/23/2016 at 23:58 |

|

In all seriousness, the effect of prices on classic cars can go both ways. Up because they become harder to obtain because of the tightened borders, down if fuel duties increase if a recession hits especially because a fuel duty hike hasnít been implemented in 5 years. Iím just concerned that Infiniti might pull out within the next few years

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/23/2016 at 23:59 |

|

Most likely flee considering the massive drop the GBP has to deal with.

Steve in Manhattan

> Flavien Vidal

Steve in Manhattan

> Flavien Vidal

06/24/2016 at 00:00 |

|

It would have been much better for this to have happened on a Friday to give the markets time to digest it. Thursday? Prepare for the shitstorm.

For Sweden

> TwinCharged - Is Now UK Opponaut

For Sweden

> TwinCharged - Is Now UK Opponaut

06/24/2016 at 00:01 |

|

Iíll shoot some electrons at them and neutralize them

Jcarr

> Flavien Vidal

Jcarr

> Flavien Vidal

06/24/2016 at 00:02 |

|

Eh, we Yanks did this 240 years ago and were still kicking.

The Dummy Gummy

> Flavien Vidal

The Dummy Gummy

> Flavien Vidal

06/24/2016 at 00:04 |

|

That doesn't even make sense? Flee and lose money due to a weaker pound? I'd expect more money to funnel in due to buying power has just increased exponentially.

The Dummy Gummy

> Steve in Manhattan

The Dummy Gummy

> Steve in Manhattan

06/24/2016 at 00:05 |

|

Batten down the hatches.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 00:07 |

|

Assuming the pound stays low, possibly. But it will buy more, too, and this wonít really break Britain.

Worst case, more of it will flow into my backyard and make property that much more unaffordable.

Panther Brown Tdi Volvo Shooting Brake Manual Miata RWD Wagon Stole HondaBro's Accord.

> Flavien Vidal

Panther Brown Tdi Volvo Shooting Brake Manual Miata RWD Wagon Stole HondaBro's Accord.

> Flavien Vidal

06/24/2016 at 00:07 |

|

Lol next time I go to the UK I will be searched and searched an searched because of who I am.

Flavien Vidal

> The Dummy Gummy

Flavien Vidal

> The Dummy Gummy

06/24/2016 at 00:12 |

|

Too much uncertainty. You donít want to send your money into a country that might end up having to pay high tariffs and see its economy plunge within the next 3 or 4 years.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 00:14 |

|

It will buy more in the UK. But the total uncertainty of the next 3 or 4years will most likely push foreign investors outside of the country.

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

06/24/2016 at 00:17 |

|

Uh the value of the Pound is falling because itís leaving the country, not entering. By the time the stock market opens theyíll be selling Pounds faster than you can say ďEU referendumĒ. Itís already significantly fallen and the FTSE hasnít even reopened.

TwinCharged - Is Now UK Opponaut

> Steve in Manhattan

TwinCharged - Is Now UK Opponaut

> Steve in Manhattan

06/24/2016 at 00:18 |

|

Tradition man, tradition.

Spridget

> Flavien Vidal

Spridget

> Flavien Vidal

06/24/2016 at 00:23 |

|

I have 15 bucks, an old Pepsi bottle, and a Subway gift card. Do you think I can buy Caterham (the whole company, not just one car)?

Dusty Ventures

> Steve in Manhattan

Dusty Ventures

> Steve in Manhattan

06/24/2016 at 00:29 |

|

PatBateman

> Flavien Vidal

PatBateman

> Flavien Vidal

06/24/2016 at 00:30 |

|

...And to the US.

PatBateman

> Steve in Manhattan

PatBateman

> Steve in Manhattan

06/24/2016 at 00:32 |

|

Tomorrow will be an over-reactionary shit show. This isnít as bad as some will say it is, but Iíll be getting to work tomorrow at 6:30 to call clients and read my analystsí reports.

PatBateman

> Panther Brown Tdi Volvo Shooting Brake Manual Miata RWD Wagon Stole HondaBro's Accord.

PatBateman

> Panther Brown Tdi Volvo Shooting Brake Manual Miata RWD Wagon Stole HondaBro's Accord.

06/24/2016 at 00:33 |

|

Lube up before you exit the plane. :(

citizenlambda

> PatBateman

citizenlambda

> PatBateman

06/24/2016 at 00:36 |

|

Iím on a floor in London. itíd already an overreactionary shitshow.. just look at cable go

PatBateman

> citizenlambda

PatBateman

> citizenlambda

06/24/2016 at 00:38 |

|

Right now, Iím searching my firmís mobile research app for new material. Nothing yet. It'll all even out in the wash, but the average American Joe will be scared when they wake up. My clients are prepared, but some will still be calling.

PatBateman

> citizenlambda

PatBateman

> citizenlambda

06/24/2016 at 00:39 |

|

Also, I'm sure that some random asshole will be on CNBC predicting a 50% drop or something. Just more fuel for the fire.

Flavien Vidal

> PatBateman

Flavien Vidal

> PatBateman

06/24/2016 at 00:41 |

|

And Japan... The Yen is going up really fast already. Hopefully not too much as I get paid in USD and Euro :(

Steve in Manhattan

> PatBateman

Steve in Manhattan

> PatBateman

06/24/2016 at 00:43 |

|

So much of our (and othersí) financial history is panics. We learn nothing.

Steve in Manhattan

> citizenlambda

Steve in Manhattan

> citizenlambda

06/24/2016 at 00:44 |

|

can you live tweet it? ( Iím @blogenfreude ) and best of luck to you. hereís hoping your positions do well, or at least not so poorly.

Steve in Manhattan

> Dusty Ventures

Steve in Manhattan

> Dusty Ventures

06/24/2016 at 00:47 |

|

For a split second, I thought it was the Prometheus trailer, and that movie was a shitshow as well.

PatBateman

> Flavien Vidal

PatBateman

> Flavien Vidal

06/24/2016 at 00:49 |

|

They really should have held this vote tomorrow.

citizenlambda

> Steve in Manhattan

citizenlambda

> Steve in Manhattan

06/24/2016 at 00:50 |

|

Canít tweet from here but happy to touch on whatís going on here. Not in a trading position fortunately, so notas stressful as it might be for me. Only rhr Asian markets are open now, so aside from FX, not much going on yet. European stocks trading in HK seem down, JPY is up so far.

PatBateman

> Steve in Manhattan

PatBateman

> Steve in Manhattan

06/24/2016 at 00:50 |

|

There's a term for what you should do when there is blood on the streets...

Steve in Manhattan

> citizenlambda

Steve in Manhattan

> citizenlambda

06/24/2016 at 00:56 |

|

OK - but donít bother with social media if youíre saving your (or someone elseís) ass.

Steve in Manhattan

> For Sweden

Steve in Manhattan

> For Sweden

06/24/2016 at 00:59 |

|

No, but 10 pounds 50 gets you TVR.

Flavien Vidal

> PatBateman

Flavien Vidal

> PatBateman

06/24/2016 at 01:00 |

|

Yeah, that would have ruined their week end... :)

For Sweden

> Steve in Manhattan

For Sweden

> Steve in Manhattan

06/24/2016 at 01:14 |

|

There is no 50 Britain is going back to shillings and pence

Steve in Manhattan

> For Sweden

Steve in Manhattan

> For Sweden

06/24/2016 at 01:50 |

|

Hmmm - yeah, they shouldíve gone Euro ... much simpler.

facw

> JQJ213- Now With An Extra Cylinder!

facw

> JQJ213- Now With An Extra Cylinder!

06/24/2016 at 02:17 |

|

This is mostly an anti-immigration movement. The EU allows free movement of people. This has long led to concerns about the stereotypical ďPolish plumberĒ stealing UK jobs, and more recently about concerns about Syrian refugees, and other Muslims. UK citizens also take advantage to live and work elsewhere in the EU, see for example the large number of Britons living in Spain.

There is also concern about the EU parliament which can feel distant and authoritarian as its members are not directly elected (but are selected by elected governments).

However, the EU has great benefits as well, starting with the common market free trade zone across the EU. The Brexiters think that because they import more from the EU than they export to the EU, they will be able to demand whatever terms they want. However, thereís no way the EU can let that happen or it would completely disintegrate. The best deal the British can hope for is the same one Norway and Iceland operate under. However, while that deal allows free trade, it also requires freedom of movement, acceptance of certain regulations from the EU parliment, and paying various dues to the EU, so would not be accepted by the Brexiters. They could try to negotiate with each country individually, but that would be time consuming, and would likely still result in a blocking of the critical finical services sector, which drives (or at least drove) the UK economy. The Brexiters hope for a deal like the one the EU has with the Swiss, but that ignores the historical and geographical peculiarities that make the Swiss deal possible. Thereís no need for the EU to make such a deal with the UK, especially right after the UK told them to get fucked.

Some force for a deal (on both sides) may come from the need to protect EU citizens in the UK and UK citizens living in the EU, though the anti-immigrant character of the movement is again likely to torpedo any such effort.

Lastly, the Remain vote was especially strong in Scotland, and weíll likely see a renewed push for independence given the decision. In Northern Ireland the vote was more mixed, but independence might be tempting there as well, given that more isolationist policies from London would end up hurting ties with EU member Ireland.

citizenlambda

> citizenlambda

citizenlambda

> citizenlambda

06/24/2016 at 02:24 |

|

Rates rallying 30+bps (to you non finance folks: this is a yuuuge move) across the board since yesterdayís London close. Eurostoxx down 10+%. Some noise bring made in the Netherlands and others about having their own referendums.

Hoccy

> Flavien Vidal

Hoccy

> Flavien Vidal

06/24/2016 at 04:03 |

|

It will be very interesting.. My hope is that the UK, Iceland and us can cooperate to get a better EEA deal. It will be hard to do the first couple of years, but in the long term I think Norway can benefit. We do a lot of trading with the UK, so cooperating makes sense.

Flavien Vidal

> Hoccy

Flavien Vidal

> Hoccy

06/24/2016 at 04:21 |

|

You guys have tons of natural ressources revenue and most of all, youíre not stupid, acting like these ressources will last forever or something. Same for Iceland. The UK has to import pretty much all its raw material from the EU, same goes even for food. Norway also has a population 13 times smaller than the UK. What small countries with a shitload of natural resources can pull off, is not the same as what a 65 millions inhabitants country with no natural resources, a massive amount of poor working people and that needs trade with the EU to survive can do...

The Dummy Gummy

> Flavien Vidal

The Dummy Gummy

> Flavien Vidal

06/24/2016 at 06:08 |

|

There economy won't plunge. Lol

The Dummy Gummy

> TwinCharged - Is Now UK Opponaut

The Dummy Gummy

> TwinCharged - Is Now UK Opponaut

06/24/2016 at 06:14 |

|

Thatís exactly what I just said. A weaker pound increases buying from external currencies (for example yesterday the US dollar would have only been able to by 68ish pence now it can by 72, and the dollar is still getting stronger.)

Flavien Vidal

> The Dummy Gummy

Flavien Vidal

> The Dummy Gummy

06/24/2016 at 06:23 |

|

Maybe... Maybe not. Thatís this exact uncertainty about the future of the UK that may kill its foreign investment. And when Tata decides to move its production to Germany or France to avoid tariffs on RAW materials and on exportation to Europe (over 50% of its market), and when Nissan decides to leave Sunderland to ďgo back to EuropeĒ or when you realize that with a trade deficit of 300 billions, you donít cut your main trading partner like this and try to play it ďnorway-styleĒ (country that can actually afford not to be in the EU thx to all its natural ressources and its 100 billion $ trade surplus), maybe people will realize they shouldnít have been so scared of a few syrian refugees in the first place lol :)

The Dummy Gummy

> Flavien Vidal

The Dummy Gummy

> Flavien Vidal

06/24/2016 at 07:33 |

|

I agree that they shouldnít have left and your assessment on why they left, but to say itís going to plunge due to tariffs is an over statement. Almost 54% of their exports do come from the EU, but to tariff the hell out of the second largest economy and third largest by population for the EU would be a mistake/over reaction by the others.

Sure EU wonít play ball like it used to but to actively try to sink a country with tariffs will not happen unless the leaders are children.

Flavien Vidal

> The Dummy Gummy

Flavien Vidal

> The Dummy Gummy

06/24/2016 at 07:48 |

|

It will take a massive hit for sure. I hope it wonít plunge, but it will get really hurt. There is simply no reason to produce in the UK anymore. Naval industry? Go sell a 1 billion euros boat with a 10% tax added to it when you can get it in France without those. Auto industry? Why produce these 54% of cars that go to the EU in UK when it can just be produced in the EU directly without any expensive raw materials or taxes? Food industry? close to 50% of food is imported from outside of the UK because the UK simply canít produce it themselves. Thatís gonna be great with you Jaguar factory employee who just got laid off to see a 15 or 20% increase of its average shopping cart (import taxes + lack of ďEU discountĒ). And what about the few raw materials that are produced in the UK? They are all in Scottland, which after all this, might very well start another referendum for its independance and this time, get it.

So I honestly think they are screwed. And not just a little.

And exports to the EU will be hit by a minimum of 10% tax. That was already decided before the UK voted for it. And I donít see the EU changing its mind on that, they seem pissed enough the way it is right now lol.

The UK is (was?) competitive thanks to its finished products industry. But are those finished products worth the extra 10% + the extra manufacturing costs that will occur, when similar stuff can be bought directly within the EU without all those tariffs? Well, I sincerely hope for the UK they are worth it. Because with all the poor working force problem that they already have, reducing wages to compensate is not an option.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 08:21 |

|

I notice the pound regained about half what it lost when I checked last night. I donít know if Britain is so uncompetitive that everyone will flee because of this.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 08:23 |

|

Or maybe the bureaucrats and the whole ideal should have focused on trade/commerce and not immigration and other laws? Thatís really what a lot of this comes down to. Itís a great way to mobilize the populists and rightists too, who have valid reasons to doubt their own sovereignty. I see similar referendums are gaining traction in France and Netherlands right now. This will impact far more than the island, and maybe it should. The EU has needed to be reformed for a long time.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 08:35 |

|

Well, in the situation it is right now, itís not necessarily a good thing. Also this happened due to the Bank of England promissing to inject 250 billion pounds into the economy. So itís entirely artificial as of right now.

http://www.independent.co.uk/news/business/Ö

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 08:41 |

|

I agree, they went too far with immigration policies. And unlike what you may think, Iím not really pro-EU. But in the current situation leaving it over an immigration problem is shooting itself in the foot. Especially since refugees will keep on trying to access and nothing will change with or without Breixit as the UK never opened its borders and is not part of Schengen. Not to mention that the UK will still be part of the EU for the next 3 yers at least and the migrant crisis might very well be over by then.

And no, similar referendum are not getting traction in France or Netherland. Extreme right wing parties try to push for them (FN and FPO) and are vocal about it, thatís pretty much all.

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

06/24/2016 at 08:44 |

|

Yes, external currencies are buying up the Pound not because it became desirable, but because people are desperate to sell it off. Looks like youíre treating demand as if itís determined by price, rather than price being determined by demand, which is how all my economist friends look at it. And why is the dollar getting stronger? Because everyone is selling Pounds to buy dollars, which makes the Pound weaker...

The Dummy Gummy

> TwinCharged - Is Now UK Opponaut

The Dummy Gummy

> TwinCharged - Is Now UK Opponaut

06/24/2016 at 09:09 |

|

What are you even talking about? It is like youíre trying to talk to something you know, but it is apparent you donít.

You do realize your conflicting what youíre saying in the same sentence right:

Yes, external currencies are buying up the Pound not because it became desirable, but because people are desperate to sell it off .

All I was saying was that people (non-UK residents) may still buy into the British housing market because their buying power has gotten stronger due to a weaker Pound. I donít know how to make it any more layman than that.

The dollar is getting stronger because like gold it is a safe haven. I trade currency for a living, I understand economics.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 09:35 |

|

Perhaps Brussels should have made a pre-emptive offer of reform before this happened, and granted promises of sovereignty to members, to diminish fears. About the crisis being over by then, nope.

The entire EU economy will be hurt just like Britain. The island has around 65MM people, and losing that will hurt the continent. I am sure the next brilliant Brussels idea to bring in nations that will probably be like Armenia or Dagestan wonít right the ship. With slumping economies, the rightists and populists gain traction. Other places have been trying to get out too, and this will only help them.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 09:36 |

|

The EU itself injects money into the unholy union to stave off collapse, whatís the difference?

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 09:47 |

|

237.5 billion pounds? Total participation of the UK for the greece bailout was around 12.5 billion GBP....

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 09:49 |

|

British participation alone.

And there could still be a GREXIT after that, they will be emboldened as will many others. Money into a lit fireplace.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 09:52 |

|

The EU should have done lost of things... Fact is that it hasnít.

And a 450 million inhabitant economy losing 65 million people is a lot less worse than a 65 million inhabitant economy losing a 450 million inhabitant market.

In all fairness, Greece hid itís desastrous economy from the EU in order to be accepted in it in the first place... It does suck indeed, but responsability is splitted on this one.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 09:56 |

|

Coulda, shoulda, woulda - now they get to pay for it. If only they had let it be about commerce and little else. Guess we canít whine about only Murkans being dumb anymore :)

65 million is still a significant loss, and it will eventually be felt just as much at your parents house as in Croydon.

I donít see how Greece was such a surprise, many knew there would be problems and predicted the mess, better than predictions that Britain would remain. But anything to keep the alliance alive, at least for now.

Hoccy

> Flavien Vidal

Hoccy

> Flavien Vidal

06/24/2016 at 09:57 |

|

Good thing the Brits like Fish&Chips..

More seriously: Trading will have to continue for both parts to have a good economy and society. The terms the EU gives GB will be critical when other countries discuss their participation in the union, as well as what EU does internally to make the union work better. If they canít agree on new terms both inside and around the EU, it might split Europe even more.

At least we are more awake now...

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 09:58 |

|

If a Grexit ever happen it will not come from Greeks. They are in enough trouble like this to add some more. They seem to somehow stabilize themselves right now and no one want a country from the Euro zone to be kicked out. Unlike Brexit, it would be an actual serious problem for the Euro zone itself

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 10:03 |

|

If they are able to think they can just walk away from the debt and the mess and start new, it well might come from inside. They are stabilized, but against what debt with money from who? Itís a lot more artificial than the British bank offering to inject 250BN just in case.

If the British action becomes a contagion, which it could, the EU does indeed have a serious problem. Weíll see what grasp of reality is had by the untouchable bureaucrats in Brussels via if they reform their over-reach. They are so full of themselves, I doubt they will get the clue.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 10:04 |

|

Oh donít misunderstand me there, itís bad. But still Brits who voted for it will have a terrible wake up :)

And yes the choice of tons of countries are rather... dubious. But then again, blame all the european countries who voted for it. ďBrusselsĒ in itself is nothing more than a democratic entity that applies the will of the countries that make the EU.

JQJ213- Now With An Extra Cylinder!

> Shmevans

JQJ213- Now With An Extra Cylinder!

> Shmevans

06/24/2016 at 10:07 |

|

I felt really stupid after asking.

I had no idea this was an actual vote. I thought it was just like a survey or something.

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

TwinCharged - Is Now UK Opponaut

> The Dummy Gummy

06/24/2016 at 11:44 |

|

No, itís not contradictory, itís exactly what it is. You donít even need to buy to sell when it comes to the value of currencies, or am I sorely mistaken?

And you never mentioned housing before. If so, there is no way a slight increase in foreign investment in housing is enough to compensate for a domestic slump in aggregate consumption which will inevitably happen when interest rates rise (and they will have to).

When it comes to aggregate demand in the housing market (and most things to be honest) in a country with a large population like the UK, consumption makes up a far higher percentage of AD than exports. As such, a slight increase in exports will nowhere near compensate for a substantial fall in consumption. AD will then fall, here comes a recession knocking at the door.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 14:25 |

|

Britain is/was the second largest economy in the EU and is still of global relevance. There will be a panic-created downturn as so much of the FIRE sector contains as much emotion as hard data. It wonít be the end of the world. Hammer out some new agreements, life goes on.

Brussels is the HQ for untouchable irresponsible bureaucracy where the will of a few guilted SJWs impacts all. EU needs to scale back and regulate trade and commerce, nothing more. If it doesnít, there will be other exits, maybe not in the distant future. I wonder if any will jump ship simply if Turkey is blindly allowed in. Maybe this will be the third time Germanyís grasp at domination was doomed by poor planning.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 20:00 |

|

That does not matter. With the UK exiting, the EU has no other choices but to apply tarriffs for all UK export toward the EU. First because it doesnít matter that much if the UK canít export its finished products anymore or if they are more expensive within the EU (the UK make its fortune with financial institutions, not through exports, enhance the massive trade deficit), but mostly because not putting tarriffs on the UK would be the end for the EU. Seeing that the UK goes away easily and with no problem, other EU countries might decide to do the same thing and leave too. Problem being that those countries also share the same currency, and problems would be much much more important than with the UK. The EU WILL tax UK exports. They have absolutely no other possible choice, even if they perfectly know that it will kill the UK economy and donít want that.

For that reason UK products WILL be taxed, and it will be no less than 10% as the EU commission specifically warned about. And really they donít seem to fuck around for once.

From the moment that the free trade agreement desappear, companies that export a lot to the EU will have no other choice but to move production to an EU country.

At the end of the day, it could actually be a good thing for the EU to have the UK leave. Its production would move to EU countries, benefiting the EU quite a bit. At the same time, the UK has no other choice but to keep on buying from the EU as it lacks all the resources to sustain itself (300 billion trade deficit) and things could get even worse if Scotland decides to leave as they own the biggest part of the UKís natural ressources. Sure the UK could buy from other countries, but they are all further and therefore more expensive. They have no choice other than t okeep buying from the EU.

The results of this referendum and if the UK goes through with it, could be an absolute disaster for the british economy and the country in general.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/24/2016 at 21:26 |

|

Doesnít matter to who? The second most powerful economy leaving the club certainly does matter. Youíve done a good job summarizing all of the trade babble thatís circulating the web, thanks. Creating a new currency wouldnít be too difficult either, especially as the Euro will collapse if more leave. But you do realize Limeyland was successful before the EU existed, back in the days of constant tariffs, right? Itís not going to suddenly revert to second world quality just from this. I am far from an Anglophile, but the island still has a lot of substance, more than many EU members.

With a rich nation leaving and much poorer nations lining to join up, I donít know if the EU is a sustainable ideal at all. Get a few more rich ones to doubt the value of the megalomaniacal union, and watch out. Will the EU reform itself back into a trade organization rather than an all-controlling political monster before then? Thatís the question. Britain will indeed suffer, but so will the union in general. In its current form, it will not have an infinite life. More nations are going to realize they have signed away too much to support others in the name of short term economics. The overpaid dipshits in Brussels need to wake up, now. I sure as hell wouldnít invest in Euro futures right now.

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/24/2016 at 21:58 |

|

No, on the long term, it doesnít really matter to the EU because the UK is dependent on what the EU countries provide. As I have said, it goes so far that the UK even has to import a very big portion of its own food supply.

Now itís a bit of a cluster fuck, but nothing thatís unsolvable for the EU. The UK needs the EU for all its raw material. The UK needs the EU to export all its automobile/naval production. It needs the EU to sell its textile/clothing production. It needs the EU to trade. Desperately. Not to mention that none of the automobile manufacturers in the UK are UK owned. So they wonít hesitate in anyway to move out of the country. That way the wonít have to pay duties when importing raw materials and they wonít face a 10% tax on the 50+% of what they produce in the UK for the EU. And considering that big companies are kings and have LOTS of rights in the UK, moving out will not be a problem at all.

And yes, if more countries leave, the EU would indeed collapse. But thanks to the UK which thankfully never adopted the Euro, this will be certainly not happen anytime soon. To prevent other countries from leaving, the EU will have no other choice but to implement quite severe tariffs and sort of make the UK an exemple of what happen when you decide to leave. Childish but necesarry to keep the EU in one piece unfortunately.

Also you cannot compare how the trading world used to work 40 years ago and how it is today, now that the EU actually exist. There was no EU 40 years ago. No prefered trading partners, not countries with tons of tax exemptions that are widely more competitive than those out of the circle...etc etc. Thinking the UK can get bac kto how things were before the EU is simply totally delusional. If the EU collapses, then yes, that would actually possible. But betting the future of the UK on a potential total collapse of the EU is MUCH MUCH more than just risky.

And keep in mind I donít like the EU very much either. Their immigration policies are damn well ridiculous and bringing in certain countries was downright a stupid mistake that they are about to do again. But the bad stuff is very much outweighted by the advantages that it brings to the countries that are part of it and that is what the UK will notice very soon unfortunately.

fintail

> Flavien Vidal

fintail

> Flavien Vidal

06/25/2016 at 12:29 |

|

IMO it appears you think the UK is going to be plunged into a depression. Itís not going to happen. I think currency valuation is a good canary in a coalmine for crises, and the pound didnít exactly collapse. You again do a good job of rehashing what the media loudspeakers are claiming about specific economics (what amount of the British economy is based on naval material or clothing, really?). but itís not that simple, not with 65MM people. There will be difficulty, but not doom. And in the worst case scenario, brexit is not binding, it can be reversed. We both know will of the people is a worthless idea over the past century.

If multiple well-off nations leave the unholy union at once, the second rate politicos might not have many options. I believe less than legal means will eventually be used against Brussels too. Nothing of value would be lost there or in Strasbourg. Making an example of someone powerful can have dangerous side effects, and punishment can go both ways. At best those self-important places might have actions like the UK saw in the 70s and 80s. The EU will not have an infinite lifespan. This could easily be the first crack in a breaking dam. Let regressing and dangerous Turkey have full membership and see what happens lol

If only the guillotine worthy ministers and other similar cowards in those two cities had the foresight to reform what was started as a benevolent economic union, and then became all-controlling, and very alienating. Do they have the balls to admit error?

Flavien Vidal

> fintail

Flavien Vidal

> fintail

06/25/2016 at 19:19 |

|

The only reason the GBP did not fall into the abyss 2 days ago, is because the Bank of England announced that it would inject 250 billion GBP into the economy to artificially maintain the pound to an acceptable level and hope to calm the UK market. As of right now, itís only maintain artificially. It was never supposed to be an instant massive fall into

Also the textile/clothing industry (and I meant to say industry instead of production, sorry, got carried away) in the UK includes roughly half a million people, itís not exactly what I would call negligeable or small. They are often the first ones to ďpayĒ in case of a crisis as the clothing budgets of people gets cut. As for the shipbuilding in the UK, well, after a quick check, it appears that the industry in the UK died 30 years ago or so... Not really up to date on that, I thought that was still important in the UK. My bad.

We can also had the banking institutions based in London, which might very well be taxed when theyíll work with the EU. That would mean for them to relocate their HQ elsewhere in the EU

And indeed, the collapse of the EU could be the one chance for the UK to be one of the smallest casualties. It would still be absolutly terrible and the entire worldwide economy would fall, but thatís still a possibility.

And yes reversing Breixit is still a possibility. Heck, itís not even done yet! But from what I read, being re-accepted into the EU would probably include conditions, like giving up on the pound. But if you try to rejoin, the pound will probably have fallen to the ground already, so Iím sure it will not be something youíll mind.

And donít forget also that the UK economy has already fallen behind France. And trust me, to fall behind us, it means things are pretty damn bad. As of right now, to save 10 billion pounds a year you spend into the EU, you lost 120 billion pounds into the market and are injecting 250 billion pound into your economy.

Also you act as if the whole EU thing was something that was forced onto you. Keep in mind the UK agreed and signed to all the rights the EU has on the soverignty of countries. Itís not some kind of a despotic entity like some would make it sound. This is something you agreed on in the first place along with the rest of the EU members. All the rights and reaches it has, are something your elected officials signed for.

But the tariffs you will have to pay to sell anything to the EU put the entire country in a terrible situation. Your production means already struggle to keep up with eastern european countries (so do all of the EU and yes, adding those countries into the EU was stupid), adding taxes over this is terrible. And out of pride (because it this situation that would be stupid for the UK who desperatly need goods and materials from the EU), the UK will certainly tax imported goods from the EU also, which will be repercuted on the final consumer.

And I donít think the UK economy will completely collapse. The EU would not let that happen as it would hurt it just as much, but I firmly believe it will go down all the way to a re-negociation for re-entering the EU. But yes, the EU will sanction that departure. And pro-breixit talking about how what the UK has to do now is ďjust see how we can do to maintain the free trade agreementĒ are truly delusional. The free trade agreement is gone for the UK. Leaving it as is, would create a sign that leaving the EU is easy and can be done without much damages and that is not something the EU can do as it would lead to its collapse.

Also for a country using the Euro, exiting would not be thinkable. The new soverign money would be devalued by a lot, national debt would increase by just as much and with the desindustrialization of most of the ďrichĒ EU, exports would not compensate the enormous loss.

As I have explained before, the only country who could exit the EU and pull it off, would be Denmark who is in a similar situation as Norway, does not use the Euro, has a big trade surplus and simply does not need the EU. For all the other countries, that would be catastrophic.

As of now, we can only hope the UK pulls it off somehow, but if they manage to do it, it will take a few decades of terrible economy for anything to maybe come out of that.

And Iím not sure why you think I re-hash anything lol. What I explain and what I write is just the most likely scenario of what could happen. What I describe is not even something Iíve read, itís just the logical result when a country with an already struggling (and mostly foreign owned) industry decides that it prefers to deal with tariffs instead of immigration. If you think TATA will give a fuck about moving its production to the EU, I sincerely think youíre wrong.